The implementation of the Bitcoin Blockchain has caused many to doubt the survival of the financial sector and the last Bitcoin Rally leaves many experts in pure perplexity. In the meantime, Distributed Ledger Technology (DLT) slowly leaves the valley of disappointments in the Gartner-Hype-Cycle towards the Slope of Enlightenment. This development is currently reflected in the prices of cryptocurrencies, among which Bitcoin has gained over its tenfold value of its low in March 2020 of 4.190 USD. With Bitcoin on the rise, we from BitCargo took a closer look at the question, which projects are already in use on a large scale showing that Blockchain will become a basic technology in the logistics industry very soon.

Since the advantages of a Distributed-Ledger are particularly evident where many players with isolated systems come together, our investigation in this two-part series focuses on transaction banking, which supports trading partners in securing and financing their activities and managing liquidity. It is characterised by domestic and cross-border payments between various players, most of which operate under uncertainty, and comparatively little regulation in terms of data protection and financial law. This means that DLT could be successfully deployed throughout the country in this area within a short time. In this blog, we present the potential of using DLT for the import / export of goods by introducing the current trading process with its commodity and financial flows and explaining how the features of Distributed-Ledgers can improve the inefficiencies in this logistics process. The second article deals with DLT-based trading processes in practice and presents three existing consortia in the field of transaction banking with their respective priorities.

DLT in Trade Finance – Use Case Import/Export

One of the most rewarding DLT-Use-Cases in transaction banking is undoubtedly the area of trade finance with the import/export of goods, since many different participants are involved in the trade process. Starting with the importer and exporter and their respective banks, through intermediaries such as correspondent banks and suppliers to supervisory authorities such as inspectors and customs officials. Figure 1 shows the traditional trading process without the Distributed-Ledger-Technology.

Figure 1: Trade Finance – Current-state process depiction (WEF, 2016)

First, the importer and exporter conclude a contract on quantity, price and delivery and payment terms and have the transaction secured by a Letter of Credit from the import bank, which sends it via its correspondence to the export bank for verification. By countersigning the Letter of Credit by the exporter, the flow of goods is initiated, the consignment is checked for contract conformity and compliance with legal requirements by the goods inspector and customs officials as well the goods are handed over to the supplier against a Bill of Lading. After a further customs verification, the goods are finally delivered to the importer, who confirms receipt to his bank and thus releases the payment transfer from the import to the export bank, which in turn is processed via the correspondent bank.

As this process involves many interfaces between participants who do not maintain a relationship of trust with each other and use information systems that are independent of each other. There is much room for inefficiency due to information asymmetry. On the one hand, this inefficiency results from the time delay in the transmission of information, its repeated verification by different parties and possible errors in the transmission of information. On the other hand, the asymmetry of information through non-interoperable systems makes it possible to manipulate, for example, freight documents or invoices.

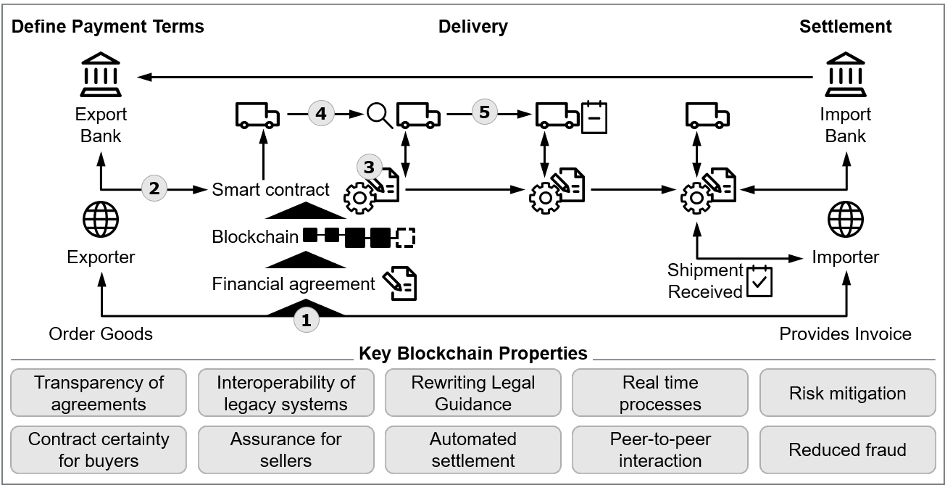

A significant reduction of these inefficiencies as well as the potential for fraud can be achieved by using a private DLT solution in combination with current information systems (Figure 2). Decentralisation, immutability, and Single Point of Truth ensure that all participants can view transaction-relevant data in real time from a trustworthy source, eliminating data transmission delays and the associated potential for error and double-checking of simple transaction data. Verifications can thus be limited to critical process steps such as checking the conditions set out in the Letter of Credit. The mediating function of the correspondent bank also becomes obsolete. The programmability of the DLT contributes to a further increase in efficiency, as the contractual conditions are recorded in Smart Contracts and processes can be triggered automatically upon their fulfilment. For example, the transfer of the invoice amount from the import to the export bank after the importer has confirmed the receipt of the goods (or in an alternative scenario the forwarder has confirmed the delivery) with his digital signature in the form of a private key. The transparency of the DLT, on which all information related to the hedging and legally compliant settlement of trades is documented, prevents manipulation and saves the banks from preparing the information necessary for anti-money laundering for the regulator, as the latter can be granted direct access to the Distributed-Ledger.

Figure 2: Blockchain opportunity for trade finance (Hofmann et al., 2019, WEF, 2016)

Decentralisation, unchangeability, single point of truth, programmability, and transparency – all these characteristics make Distributed-Ledger-Technology ideal for transaction banking for all parties involved in the trading process. Which consortia have already recognised this and which solutions they have developed based on this recognition will be the subject of the second part.

Sources:

- Hofmann, E., Heines, R. & Omran, Y. (2019). Foundational premises and value drivers of blockchain-driven supply chains: The trade finance experience. In W. L. Tate, L. Bals & L. Ellram (2019). Supply Chain Finance: Risk management, resilience and supplier management (S. 225-253). London: Kogan Page.

- World Economic Forum (2016). The future of financial infrastructure: An ambitious look at how blockchain can reshape financial services. http://www3.weforum.org/docs/WEF_The_future_of_financial.pdf

- A Trade Finance Initiative. (n.d.). https://www.marcopolo.finance/

- Bermingham, F. (2018, November 01). R3 and eight banks launch Voltron blockchain platform for trade finance. https://www.gtreview.com/news/fintech/blockchain-project-voltron-launches-open-testing-phase

- Morris, N. (2018, October 02). Trade finance blockchain consortia: How they differ. https://www.ledgerinsights.com/trade-finance-blockchain-consortium/

- Morris, N. (2018, June 11). HSBC executes live trade credit using blockchain. https://www.ledgerinsights.com/hsbc-ing-blockchain-trade-finance/

- Morris, N. (2018, May 09). Maersk outlines IBM joint venture. https://www.ledgerinsights.com/maersk-outlines-ibm-joint-venture/

- Wass, S. (2018, October 04). We.trade and Batavia merge blockchain platforms for trade finance. https://www.gtreview.com/news/fintech/we-trade-and-batavia-merge-blockchain-platforms-for-trade-finance/

- Wass, S. (2018, September 25). Marco Polo blockchain platform for trade finance released. https://www.gtreview.com/news/fintech/marco-polo-blockchain-platform-for-trade-finance-released/